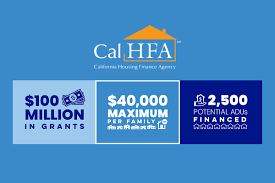

If you live in California and are considering developing an ADU, you are probably familiar with the CalHFA grant. This grant made it easier than ever to build an ADU within the state. Since it was created, though, there have been a number of improvements made to it. Here is what you need to know about the ADU grant update.

ADU Grant Recap

Before we dive into what is new with the grant, let’s first recap what exactly the grant does. The ADU grant program from CalHFA allows low-to-moderate-income homeowners access to up to $40,000 for pre-construction costs for an ADU. To get the grant, you need to meet the income requirements for your specific county and obtain a loan from a short list of approved lenders.

The funds must be used only for pre-construction costs, which make up a good amount of ADU costs in total. If you don’t use the funds within a specific time frame, they will be given to someone else.

ADU Grant Update

Since the grant was first created, there have been two major changes. The first was that CalCon Mortgage created a loan that took a second position so that you did not need to refinance your current mortgage. However, this loan had a $200,000 borrow minimum that was too high for many individuals looking to build smaller units or JADUs.

The second major change was that CalHFA added a list of special financing grant program participants. Of these new participants, one found a loophole that allowed you to obtain the grant without a loan. HPP Cares allows you to receive the ADU grant without having to take out a loan if you don’t need to.

The way it works is you take money from your savings, or past loans and put it into a managed escrow, and then HPP Cares wires the grant money into the same managed escrow. As you complete milestones, you will be given a certain amount of your funds for the next step. Inspectors come to see your progress and let the third party who manages the managed escrow know when you are ready for the next set of funds.