What is National Finance Commission?

The National Finance Commission in the United States represents a framework for how financial resources are shared between the federal government and individual states. Rooted in the principles of fiscal federalism, such commissions ensure that revenue distribution and fiscal transfers are equitable, allowing state governments to manage public services effectively. They are vital because the federation relies on balanced resource allocation to minimize disparity and strengthen state autonomy, which is also a concern among the provinces in Pakistan. By creating a system where funds flow fairly from federal revenues to state administrations, the NFC reinforces cooperation, reduces economic inequality, and sustains a stable relationship between the federal and state governments.

Historical Background of the National Finance Commission

Establishment and Concept of Fiscal Commissions

The idea of a National Finance Commission in the United States reflects fiscal decentralization, where government finance is shared between the federal and state governments, paralleling the principles outlined in the Constitution of Pakistan. Such commissions were established to ensure equitable allocation of revenue and strengthen the federation, paralleling the role of the National Finance Commission in Pakistan.

Evolution of Resource Distribution in the U.S.

Over time, the distribution of resources between the federal and provincial-like state governments has evolved through new formulas and fiscal transfers. This shift promotes fairness, decentralization, and reduces disparity among the states.

Role of the Federal Government and Treasury Department

The federal government and the Treasury Department play a key role in overseeing taxation, allocation, and distribution of revenue, ensuring transparency in fiscal federalism.

Objectives of the National Finance Commission

Fair Distribution of Federal Resources

The National Finance Commission ensures that federal revenue is distributed through an equitable allocation system, balancing government finance between the federation and the states.

Addressing Disparities Among States

By reallocating resources, the NFC reduces fiscal disparity among states, supporting fair development and minimizing economic inequality.

Strengthening Fiscal Federalism in the U.S.

Through transparent fiscal transfers, the NFC strengthens fiscal federalism, reinforcing cooperation between the federal and state governments.

Promoting State Autonomy and Local Development

Fiscal decentralization empowers states to plan budgets, improve provincial-style governance, and invest in local development, ensuring sustainable growth across the federation.

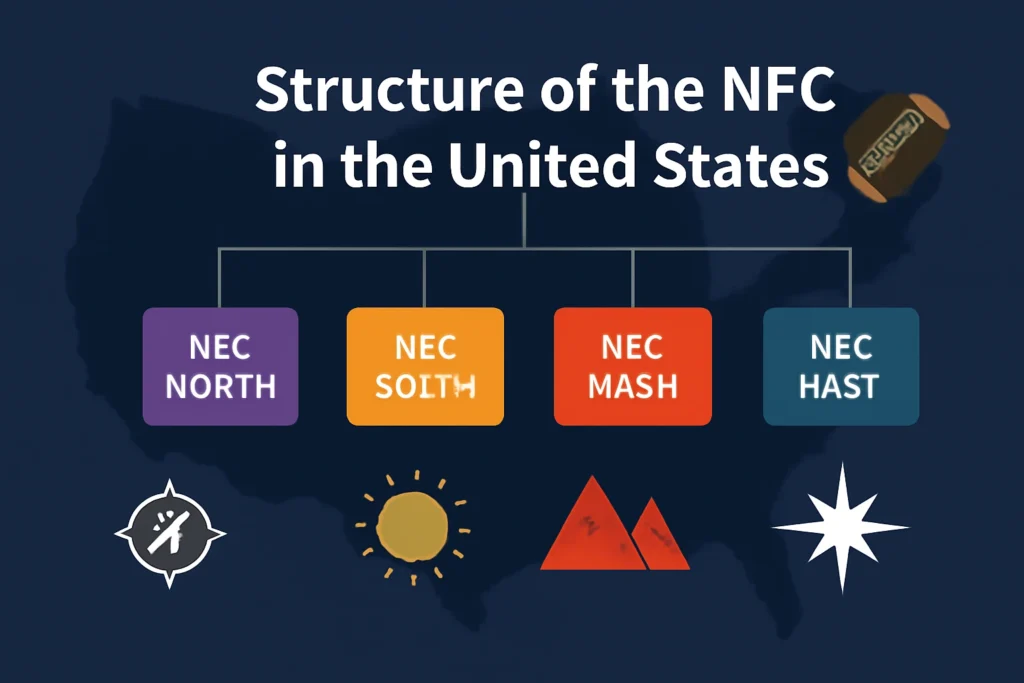

Structure of the NFC in the United States

Federal Representation in the Commission

The National Finance Commission in the United States includes representatives from the federal government, often led by the Treasury Department, to oversee revenue-sharing and fiscal transfers between the federation and the states.

State Representatives and Experts

Each state is represented through finance officials and independent experts who provide insights on government finance, equitable allocation, and fiscal federalism, ensuring that diverse economic needs are addressed.

Decision-Making Mechanism

Decisions within the NFC are reached through consultation, where both federal and state representatives collaborate on resource distribution, taxation policies, and revenue-sharing formulas, creating a balanced and transparent framework for fiscal decentralization.

National Finance Commission Award (NFC Award)

What is the NFC Award in the U.S.?

The NFC Award in the United States is a fiscal framework that guides how resources are distributed between the federal government and state governments. It ensures fairness in revenue-sharing and strengthens fiscal federalism, much like the objectives of the 7th NFC Award in Pakistan.

Vertical (Federal vs. States) and Horizontal (Among States) Distribution

Vertical distribution allocates revenue between the federal and state governments, while horizontal distribution divides resources equitably among the states to reduce fiscal disparity.

Federal Revenue Sharing Mechanism

Through the divisible pool of federal taxation, fiscal transfers are made, ensuring states receive their fair share for governance, development, and local needs.

Example of Resource Allocation Formula

| State/Region | Share (%) |

|---|---|

| California | 20% |

| Texas | 15% |

| Florida | 10% |

| New York | 10% |

| Remaining States | 45% |

Fiscal Federalism and NFC in the United States

What is Fiscal Federalism?

Fiscal federalism refers to the system of distributing financial resources between the federal government and state governments. It ensures fiscal decentralization, balanced governance, and effective management of revenue-sharing.

Role of NFC in Strengthening Federal–State Relations

The National Finance Commission strengthens cooperation within the federation by creating a transparent allocation system, similar to the frameworks established in Pakistan. Through fiscal transfers and revenue distribution, it builds trust between federal and state authorities, akin to the collaboration seen among the provinces in Pakistan.

Benefits of Equitable Distribution of Revenue

Equitable allocation of resources reduces economic disparity, empowers state governments, and promotes sustainable development. This fair distribution of revenue ensures that every state benefits from the federation’s collective financial resources.

Challenges in NFC Implementation

Political Disagreements Between States

Conflicts often arise when states feel their share of revenue allocation is unfair, creating hurdles in achieving equitable distribution among the federation.

Federal Budget Constraints

When the federal government faces budget deficits, fiscal transfers to states may be limited, reducing funds available for state governments and local development.

Delays in Announcing New Distribution Formulas

Delays in reviewing and updating NFC formulas cause fiscal disparity, as states continue to operate under outdated revenue-sharing mechanisms, reflecting challenges faced by provincial governments in Pakistan.

Need for Modernized Fiscal Policies

Evolving economic needs highlight the importance of updating taxation systems, revenue-sharing methods, and fiscal decentralization policies to ensure efficiency and fairness.

Importance of NFC for the U.S. Federation

Unity Among States

The National Finance Commission fosters unity by ensuring fair distribution of federal resources, strengthening trust among states within the federation.

Empowering State Governments

Through fiscal transfers and decentralization, state governments gain the autonomy to manage revenues, implement policies, and address local financial priorities effectively.

Reducing Regional Economic Disparities

By allocating revenue equitably, the NFC reduces fiscal disparity and supports balanced economic growth, ensuring underdeveloped regions receive resources for development and stability.

Related Insights – Starting a Business in the U.S. Fiscal Environment

Fiscal Decentralization and Business Opportunities

Fiscal decentralization not only benefits state governments but also creates opportunities for entrepreneurs. When states receive equitable revenue allocations, they can invest in infrastructure, public services, and business-friendly policies, similar to the support provided to provincial governments in Pakistan. This financial stability encourages local entrepreneurship and attracts investors to regions that once lacked resources. Small businesses, startups, and service industries thrive when states enjoy greater fiscal autonomy, as it ensures fair competition and growth across diverse markets. For entrepreneurs seeking insights into building ventures in such an environment, read more about starting a photography business here.

Further Reading on U.S. Fiscal Policies

Explore More Finance Resources

Understanding fiscal federalism and revenue distribution helps explain how government finance shapes both state autonomy and national growth. To dive deeper into topics like fiscal transfers, equitable allocation, and financial governance, explore more resources and expert insights at TechyInfinity.

FAQs About the National Finance Commission

What is the National Finance Commission in the U.S.?

The National Finance Commission (NFC) in the United States is a federal–state financial framework that ensures fair distribution of revenue between the central government and individual states, much like the 7th NFC Award in Pakistan. It is designed to maintain balance in fiscal capacity and provide resources for state development.

What is the difference between NFC and NFC Award?

The NFC is the institutional framework responsible for designing fiscal distribution formulas, while the NFC Award refers to the actual revenue-sharing formula and allocations decided during a commission cycle.

How often is the NFC Award reviewed in the U.S.?

In principle, the NFC Award is reviewed periodically to reflect changes in economic conditions, population, and federal budgetary needs. However, political disagreements and administrative delays often affect the frequency of these reviews.

What role does the Federal Government play in NFC?

The federal government plays a central role by leading negotiations, setting fiscal benchmarks, and ensuring equitable distribution across states while balancing national priorities with regional needs.

What challenges does NFC face in the United States?

The NFC faces challenges like political disagreements between states, federal budget constraints, delays in announcing new formulas, and the need for modern fiscal policies that align with current economic realities.

How does NFC affect state autonomy?

By granting states a fair share of federal revenue, NFC empowers them to implement their own policies, strengthen public services, and reduce reliance on federal transfers. This enhances autonomy while maintaining national unity.

Why is revenue-sharing important for U.S. states?

Revenue-sharing ensures that both resource-rich and resource-poor states can access sufficient funds for development. It reduces economic disparities, promotes equality, and sustains smooth federal–state relations, akin to the goals of fiscal federalism in Pakistan.

What is fiscal federalism and how does NFC strengthen it?

Fiscal federalism refers to the financial relationship between federal and state governments. NFC strengthens it by institutionalizing revenue-sharing, building trust between states, and promoting cooperative federalism across the federation, similar to the objectives of the Minister of Finance in Pakistan.

Conclusion

Final Thoughts on NFC’s Role in the U.S.

The National Finance Commission (NFC) plays a pivotal role in maintaining a fair and transparent revenue-sharing system between the federal and state governments in the United States and is reminiscent of the fiscal federalism in Pakistan. By ensuring equitable distribution of resources, the NFC not only strengthens fiscal federalism but also promotes unity, empowers state governments, and reduces regional disparities, echoing the efforts of fiscal federalism in Pakistan. Although challenges like political disagreements and budget constraints remain, the NFC continues to be a cornerstone of cooperative federalism, shaping the financial stability and growth of the U.S. federation.